Benazir Income Support Programme Qist Start

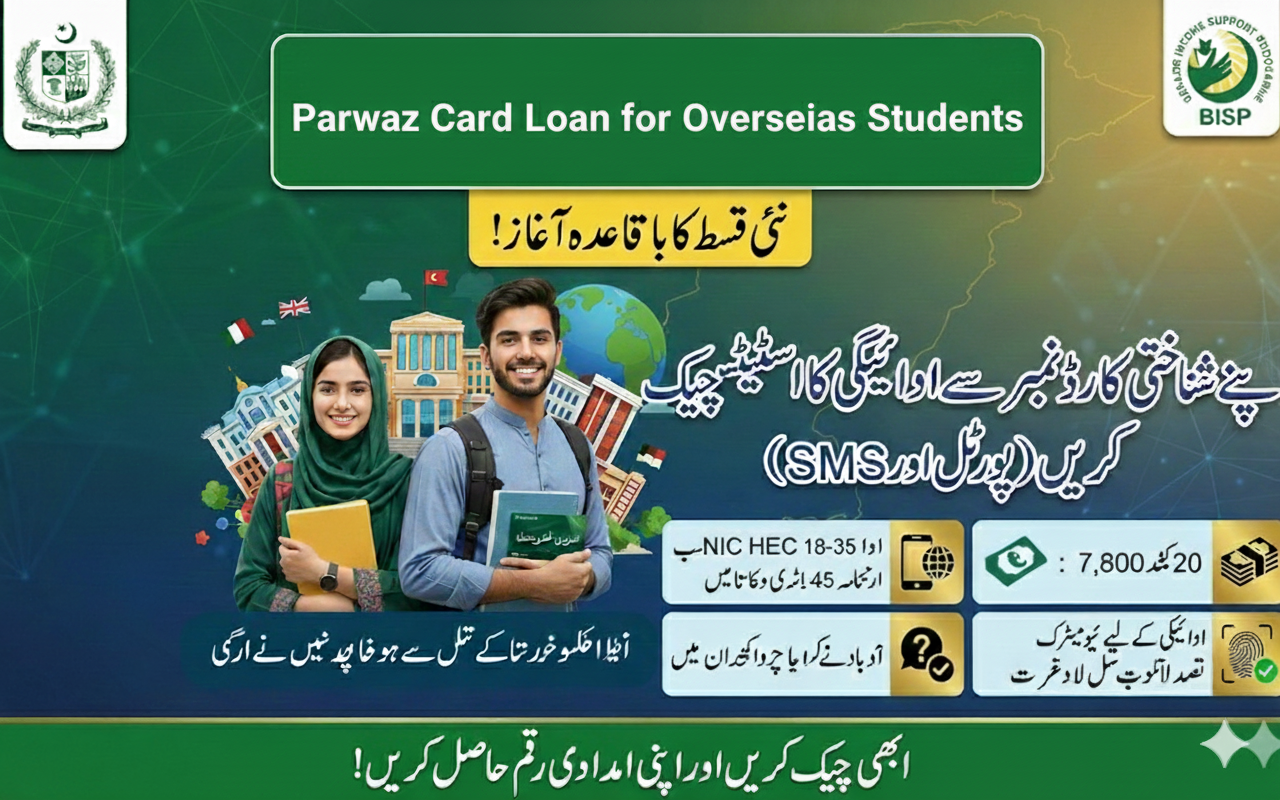

The Parwaz Card Loan for Overseas Students is a major government initiative designed to support Pakistani students who want to study abroad but face financial difficulties. Many talented students secure admission to universities in the UK, USA, Canada, Australia, and Gulf countries, yet cannot proceed due to high tuition fees and initial living costs. This scheme aims to remove those barriers and make international education accessible.https://parwaaz-psdf.org.pk/

The Parwaz Card Loan is part of a broader youth empowerment vision of the Government of Pakistan and the Punjab Government. By providing interest-free or low-interest financial assistance, the program helps students focus on education rather than financial stress, while also contributing to national skill development.

You Can Also Read: BISP Update January 2026: Rs. 16,500 Installments Released in 15 Districts

What Is the Parwaz Card Loan for Overseas Students?

The Parwaz Card Loan is a government-backed educational financing program for Pakistani students admitted to foreign universities. Instead of providing cash directly, the government issues a Parwaz Card, which works like a digital debit card and ensures transparent use of funds.

The loan can be used for multiple education-related expenses, making it a comprehensive support system rather than a single-purpose loan. It is especially helpful for middle- and low-income families who cannot arrange large upfront amounts.

- Payment of university tuition and admission fees

- Visa processing and air tickets

- Initial hostel or accommodation expenses

- Emergency or basic living costs abroad

You Can Also Read: Apni Zameen Apna Ghar Balloting Result 2026 Check Online

Key Features of Parwaz Card Loan 2025–2026

The Parwaz Card Loan 2025–2026 comes with flexible terms to support students throughout their study period. The program focuses on transparency, affordability, and easy repayment after education is completed. Students benefit from delayed repayment and government oversight, which reduces misuse and financial pressure. Partner banks ensure proper verification and smooth disbursement.

- Program Name: Parwaz Card Loan for Overseas Students

- Loan Type Interest-free/low-interest

- Maximum Amount Up to PKR 2 million

- Repayment Start: One year after graduation or employment

- Application Mod:e Online and partner banks

Eligibility Criteria for Parwaz Card Loan

To apply for the Parwaz Card Loan, applicants must meet basic eligibility requirements set by the government. These conditions ensure that the loan reaches deserving students who genuinely need financial assistance. The program also gives preference to certain categories to support balanced national development and inclusion of underserved regions.

- Pakistani citizen with a valid CNIC or B-Form

- Age between 18 and 35 years

- Admission offer from an HEC-recognized foreign university

- Middle- or low-income family background

- Both male and female candidates can apply

You Can Also Read:NADRA Introduces Facial Recognition Biometric System to End Fingerprint Verification Issues

Documents Required for Application

Applicants must prepare all required documents before starting the application process. Incomplete or incorrect documentation can delay verification and approval. Keeping scanned copies ready helps in smooth online submission and faster processing through partner banks.

Document Requirement

- CNIC or B-Form Valid and readable

- Passport Minimum 6 months validity

- Admission Letter From foreign university

- Educational Certificates: Attested copies

- Income Certificate,e Parent or guardian proof

You Can Also Read:

Key Features of Parwaz Card Loan 2025–2026

The government has simplified the Parwaz Card Loan application process to make it accessible across Pakistan. Students can apply online or through designated partner banks such as NBP, BOP, and ABL. After submission, applications go through verification from NADRA, HEC, and the bank before approval and card issuance.

Application steps include:

- Visit the official Parwaz Card portal or partner bank

- Fill out the application form carefully

- Upload or attach required documents

- Apply for verification

- Receive the Parwaz Card after approval

You Can Also Read: Punjab Intermediate Annual Exams 2026 Complete Guides & Details

Loan Amount and Repayment Terms

The Parwaz Card Loan provides flexible financial coverage depending on students’ needs. Tuition fees receive the highest allocation, while other expenses are covered within set limits. Repayment starts one year after graduation or once the student secures employment, whichever comes first. This structure allows students to stabilize financially before repayment begins.

FAQs

What is the Parwaz Card Loan for Overseas Students?

It is a government-supported loan that helps Pakistani students finance education abroad through an interest-free or low-interest system.

Is the Parwaz Card Loan interest-free?

Yes, most applicants receive interest-free loans, especially those from low- and middle-income families.

Who can apply for the Parwaz Card Loan?

Pakistani citizens aged 18–35 with confirmed admission to an HEC-recognized foreign university can apply.

When does loan repayment start?

Repayment begins one year after graduation or once the student starts earning.

You Can Also Read: Diamer BISP Beneficiaries Notice:

Conclusion

The Parwaz Card Loan for Overseas Students 2025–2026 is a powerful step toward educational equality and youth empowerment in Pakistan. By removing financial barriers and offering transparent, student-friendly terms, the program enables thousands of students to pursue global education and return with valuable skills. Eligible students are encouraged to apply early through official channels and benefit from this transformative initiative.